If things were to go south (which personally, I seriously doubt they will) the best the customers could hope for would be a small fraction of that $28,000,000 as the company would keep trying to get to the promised land until every last avenue (every last dollar) was exhausted. They don’t just have $9,000.000 to play with, they have the entire $37,000,000. It would be a little bit more than naive to believe the $28,000,000 is sitting in some escrow account waiting for our approval to release to suppliers as they start building our units. Well, I know I didn’t sign any escrow agreement when I paid for my Glowforge Pro unit.

This is exactly how I feel as well! Although I paid $4000 for the Pro…

With shipping to Canada I have paid $4,498 U.S. for the Pro (so far). Add Canadian taxes and that becomes $5,100 U.S. Convert that to Cdn. dollars and you have ~ $6,800. It’s becomes a fairly big number. ![]()

I love this thread!

Why? First, because I’m not creative/artistic, I will not use my Glowforge for creative/artistic things. Don’t get me wrong, I do love seeing the creative things others can and will do with their units. You get to see what might be possible.

Second, because I spent almost my entire career as a “what if” guy in the world of commercial real estate development deals from the developer side of things. And I’m here to say that’s something you just can’t turn off.

So when threads start up that are directed at techie or financial aspects, my ears perk up and the gears start spinning. It’s a beautiful thing for people like me.

Let the wheels spin. . .

Scenario #1. All the hardware and software development is completed beyond everyone’s wildest expectations, the crowdfunding units are shipped by October 2016 and Glowforge only burned through half of the $9,000,000 in Angel Funding investment. My personal favourite among scenarios as EVERYONE ends up with a big dumb ass grin on their face.

Scenario #2. Turns out things were underestimated a bit. Favourable costing from Pacific Rim manufacturing didn’t pan out and way more staff had to be hired to realize the software vision. Another $9,000,000 in costs are required to be incurred (and we already know this can happen based on the move to onshore assembly and the give-away stuff from the pushing off of the shipping date). Angel Fund investors pony up, crowdunfing units are shipped by March 2017. My second place personal favourite among scenarios as EVERY customer ends up with a big dumb ass grin on their face. Investors are less happy, but I’m guessing since they pony’d up, they are OK with the reduced return or more likely the negotiated increase in equity participation.

Scenario #3. Same as scenario #2 to the point of where the badly needed $9,000,000 additional development funding comes from the Angel Fund investors (all sources) whom say they are in as far as they’re willing to get in. Now assume conventional financing is also unavailable. So what do you do. I know, you ask the crowdfunders to pony up the required $9,000,000. Hey, that’s only like an additional $1,000 each. Well, I can tell you now, 10,000 people chipping in another $1,000 ain’t ever going to happen.

What to do, what to do. . .

I know, we dip into the $28,000,000, for as we all know, there are no restrictions on the use of those funds. The $28,000,000 becomes $19,000,000 but we make it to the finish line with the hardware and software beyond anyone’s expectations, but not a single unit has yet to be shipped. Why you ask? Well, because the $28,000,000 was actually the cost to produce those 10,000 units. What to do, what to do. . . So many roads to consider at this point, none of which are going to put a smile on either the customer or investor’s faces. My least favourite scenario as no one goes home happy. Hey, but that’s life in the “what if” world of financial modeling.

There are an infinite number of other possibilities. . . If we only had more time on this earth. . .

I understand that 95% of the “group” absolutely hate the way the “what if” scenario guy’s mind works and they wish he was just like most of the others that are absolutely gobstruck by the artistic potential of this beast we call the Glowforge. Well if it makes you feel any better, I am gobstruck by the potential of this Glowforge thing, it’s just that I’m still also the “what if” guy. . .

I’ve seen you mention this name a couple of times. Where did this info come from?

“Announcements” Thread: Glowforge shipping date, beta releases, and bonus materials

I’ve read the thread but still don’t see a manufacturing plant named - just assembled in the USA. Only mention of the specific plant on the forums has been by you. Not saying you’re wrong - just curious if you’re making an educated guess or what.

OK, if you are asking the name location of the USA plant I have no idea and have never said or implied otherwise. If you have seen otherwise, please point me to that thread.

If you are asking about my references to a “Pacific Rim” plant, that is a generic reference to countries in that region such as China, Hong Kong, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam.

Hope that helps.

That helps. I was reading it as if you were naming a specific manufacturer rather than a region.

I appreciate how you have shown that perception, expectations and needs are radically different. No one answer or response suits everyone. Sometimes we have to let threads develop where they go instead of throwing road blocks up.

I was not trying to be mean if this is what the WOW is.

I agree with the basic premises of your scenario’s, I just disagree with some of the dollar amounts you gave. I can’t see a scenario where they will need another $9,000,000 unless there is significant hardware issues and a full redesign has to happen. Not knowing how much of the $9mil they have already spent, there could be a cost overrun, I just don’t think it will be close to $9,000,000.

It’s all just “what if”. But, we know it’s already over $1,000,000 for the delay freebies plus whatever the cost differential between assembling in U.S. vs China will be crewing away at the margin. Again, it’s just about trying to compare budget to actuals while wearing a blindfold.

Zen Accounting?

You must become one with the numbers. ![]()

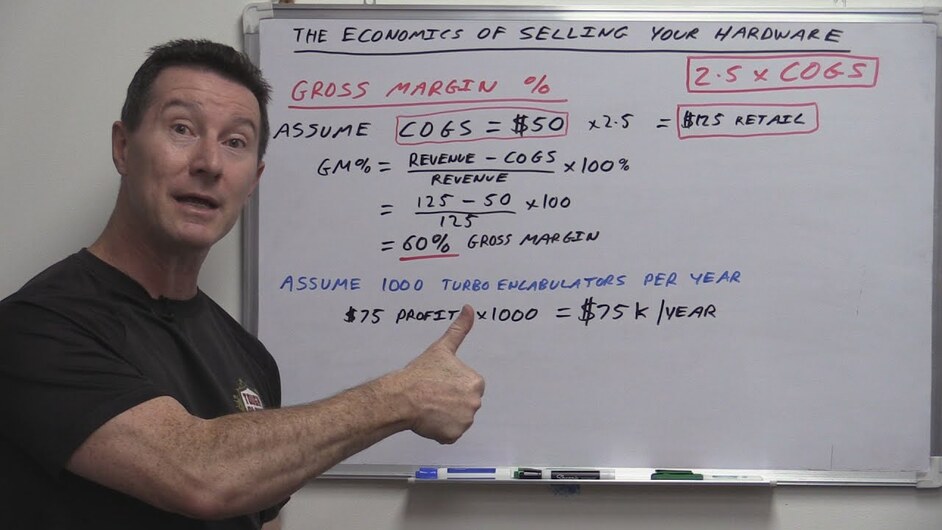

You mentioned chewing away at the margin. That actually pointed out the main flaw in the original scnarios you presented: Their margin on each sale was not factored into any of your scenarios, and in fact you explicitly assumed a zero margin when you said that the 28,000,000 was the cost of manufacturing in the third. I didn’t really like the original scenarios post, but it took your follow-up comment mentioning margin to clarify what it was I didn’t like about it; Even a relatively small margin on 10,000 units could go a long way towards defraying the impact of any significant overrun.

I am pretty much certain that they had at least a 10% margin built into the pre-sale pricing even during the initial 50% off MSRP pre-sale period, which has of course increased significantly on every unit sold since October 25. I am equally certain that the switch to domestic (US) manufacturing and the freebies for the delay fit comfortably within that margin, since the investors would have been much less amenable to those decisions otherwise.

It had been stated that the 9MM initial investment was enough to sustain their expected staffing and day-to-day operations for a couple of years, and if that is true, that should carry them well beyond their actual production start date (which I still expect will be by mid October 2016 at the latest). At that point, their remaining margin on all of their pre-sales (if any), and all of their margin on ongoing sales (after subtracting the cut they will then owe their investors) will be available to defray the costs of ongoing operations.

With these points in mind, it seems likely that the final outcome will be most like your best case scenario 1, with mainly the dates being in question.

lol. . . Yes, there’s always another scenario.

Typical retail for high-tech stuff ranges from 2x-5x the bare cost, to allow for development, NRE, marketing, support, blah blah blah. So I wouldn’t be worrying about margin at this point.

What does worry me a bit in the longer term is what happens next, and how they handle the transition from getting the pre-sold units out the door to selling more. Because (one assumes) they’re not just going to shut that production line down sometime in Feb '17. Has everyone who could want a GF already ordered one, or are they planning for the buzz from thousands of units out in the wild stimulating a bunch more sales of GF1? (Hmm, GF2 about the time that tubes are starting to wear out on the first models?)

So they have had pre-orders open continuously, and I recall reading somewhere (not sure if it was a thread here, announcement, or something else) that they have steadily sold pre-orders. And like you said, having the pre-orders out in the market (trickling from the December delivery to early backers through to May for pre-orders) will stimulate sales. In the short term they certainly don’t have any problems. It is the longevity of the demand that could pose a problem down the line. Like you said, how many people want or think they need a laser and haven’t already ordered it? I had no need/desire for one until I saw the campaign and I’m sure there are many already in that boat, so how many remain?