We have also decided we are going to just let them deliver our Glowforge and filter straight to us here in Calgary. We had considered having them delivered to a warehouse in Sweetgrass Montana, but decided that we really did not want to have to drive down there in the middle of winter and then risk messing up the paperwork and having trouble getting them home with us.

I’m picking mine up across the border. I should be one of the first as I ordered on day one. I’ll definitely post anything I learn bringing it across the border. I was too cheap to spring for the extra shipping costs.

I’m doing the same thing. The border’s only an hour drive from Ottawa, so it’s not too bad. I don’t know what kind of documentation we need to bring with us. Do we need a receipt of the GF to prove the cost?

Based on $300 for shipping I’m hoping duty is prepaid… however I’m expecting a bill when it gets here.

Yes, I’m bringing both my Glowforge invoice and both my Visa receipt(s) as I originally had basic and then upgraded to pro. They base taxes off the CDN price so I’m hoping they will go from my actual CDN cost, not what the US invoice would be at today’s exchange rate. I’ll let you know how that goes though. I’m expecting no duties and only taxes.

I’m personally just going to let the carrier bring it here to Edmonton, and then self-broker. UPS will want around $100-105 in brokerage fees + GST (it’s a service!). It’s a slight pain in the ass (CBSA is at the airport, 33km away) but hopefully I can get PDFs of all the courier paperwork instead of running everywhere.

Nice couple of links.

Step #1. . . Get a BN for the official purchaser name of the Glowforge!

Hopefully every Canadian planning to do their own customs clearing understands they can’t do Step #1 with the CBSA agent who’s sticking his head in the window of your car as you are sharing your intent to clear the Glowforge unit.

I have to say, learning about the paperwork and getting it right the first time, registering for a BN (which you’ll want to subsequently cancel ASAP), travelling an hour and a half each way (to the U.S. from here in Ottawa anyway) to the boarder, all-in probably taking the better part of a day and probably $80 in gas to save $100 - $105 is not something than would not have a net benefit for me personally. All that effort to save a net $25?

However, the ability to clear in your own town definitely a possibility.

If you really want to get down into it, individuals can’t exactly cancel the BN, since it’s tied to your SIN for income tax and GST purposes.

But yeah, you do have to do a certain amount of leg work before they should be letting it across.

If you already have your individual BN, that’s an important first step. You can get it over the phone. The real meat and potatoes is in bullet 14: they have a Commercial Cash Entry Processing System (CCEPS) to assist with the paperwork in larger ports of entry; doubtful they will have them at the 1-2 man entry points. ![]()

Thanks for the replies everyone. I think we would all welcome the input from people as they start sending out the units.

So, please don’t forget to post any relevant information so the community can learn from any mistakes made along the way.

I got VERY bored today, and wrote this point-by-point to the step-by-step guide, for those thinking of self-brokering…

-

Obtain a Business Number.

While you could probably do this online, call 1-800-959-5525 and talk to a rep. They’re actually quite nice. Tell them you’re importing a commercial product, and require an individual Business Number for the paperwork. They’ll want personal tax details, and give you the number. That’s it.

``

If you already have a business (ie.- I’m a consultant with my own registered business), just advise them you want to add an ‘RM’ account to your business. -

Identify the goods you want to import.

This is really kind of superficial, but print this page and keep it on-hand: https://glowforge.com/tech-specs/ -

Determine if you will use the services of a licensed customs broker.

Short answer: NO. -

Determine the country of origin for the goods you are importing.

Glowforge will provide this information at the time of shipment. In fact, it should already be attached to the box in an envelope of customs documents when it was shipped. If they didn’t, then support@glowforge.com should be able to provide the BOM (build of materials). -

Ensure the goods you wish to import are permitted into Canada.

Short answer: YES. Unless you count lasers as porn. Some people do. I don’t judge.

-

Determine whether the goods you intend to import are subject to any permits, restrictions or regulations by the CBSA or other government departments.

Again, Glowforge will provide this information when the time comes. Examples of documentation they’ll likely include:

- FCC verification of compliance (for the wireless)

- CE verification of compliance for other

- UL certification (for the electrical and power connections)

- RoHS compliance (Restriction of Hazardous Substances in Electrical and Electronic Equipment), for the case design and/or other parts [typically EU nations]

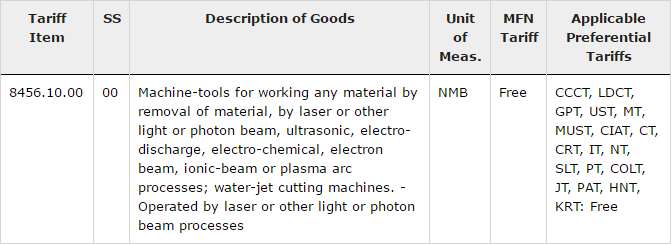

- Determine the 10-digit tariff classification number for each item you are importing.

The code is 8456.10.0000 for the laser cutters themselves. Because Glowforge has a separate SKU for the filters, they’ll have different tariff codes (and documentation, above).

Don’t know what the tariff classification of the filter is? Don’t sweat it. It will be listed on the CCD document in bullet 13. Because you have to obtain this document as a key step, you should probably contact the Courier/Carrier to find the details, next.

- Determine the applicable tariff treatment and rate of duty.

Keep in mind that this is duty, not taxes. According to the latest CBSA schedule:

An MFN tariff is the lowest possible tariff a country can assess on another country. For example, if a country's lowest tariff is 2% of the value of a good, this is its MFN tariff, and it charges this percentage on an import from a country with most favored nation status.

``

The United States has a MFN preferential tariff under MUST (Mexico-US Tariff; aka NAFTA), which means that there is no duty on the Glowforge -- unless Donald gets elected and tears up NAFTA.

9. **Determine if your goods are subject to the goods and services tax (GST), excise tax or excise duty.**

Short answer: YES.

10. **Determine the value of the goods you are importing.**

Glowforge will provide an invoice when it ships. That determines the value. Note that this is the value of the **goods** - do not include the carrier/courier **service** fees!

11. **Estimate in advance how much duty and taxes you will be required to pay.**

This is the important part: CBSA uses the Canadian Value of the item, not the US value. You MUST convert the USD to CAD value using the Bank of Canada exchange rate at noon on the day of shipment from Glowforge – not the rate on the date you ordered from Glowforge. [http://www.bankofcanada.ca/rates/exchange/10-year-lookup/](http://www.bankofcanada.ca/rates/exchange/10-year-lookup/)

``

So the answers for my Glowforge Basic, if shipped today (exchange rate of 1.3379):

- **Value for Duty = $2669.11 CAD** [$1995 USD x 1.3379]

Value for Duty = (USD$ x BoC rate)

- **Customs Duty = $0.00**

(based on #8 above, there is no customs duty)

- **Value for Tax = $2669.11**

Value for Tax = (Value for Duty) + (Customs Duty)

- **GST = $133.46** ($2669.11 * 0.05)

GST = (Value for Tax) * 0.05 (5% GST)

- **Total Customs and Taxes = $133.46**

Total Customs and Taxes = (Customs Duty) + (GST)

12. **Place your order and select a method of shipping.**

Well if you’re here, you’ve already done that. Shipping has already been decided for you by Glowforge. But if you need a reminder of what you ordered: https://glowforge.com/account

13. **Report your goods.**

Guess what? CBSA will already know, because you’ve blown your CAN$2,500 limit. But you need the courier’s CCD. What’s a CCD? **It’s a document tied to the Tracking Number Glowforge gives you.**

14. **Obtain release of your goods.**

You might as well pay the piper up front – Method 1.

* Tell the courier you want the CCD document for the tracking number. **Make two copies.**

* Glowforge will email you an official invoice when they ship. **Print two copies of that.**

``

>I feel it's necessary to point out the difference between an INVOICE and PURCHASE ORDER here: A Purchase Order (“Order”) is a request for goods, without fulfillment or payment. An Invoice is a statement of order fulfillment, including payment information. _Get it wrong, and you'll be running around._

* Glowforge SHOULD include copies of the regulatory documents with shipments, but _they are not required to do so_ - it’s the responsibility of the importer. They really should post the documents on their website for retrieval, rather than emailing upon request... but it’s your responsibility to obtain them, print them, and have them handy - GF must provide proof of regulatory abidance, if requested.

Evil side note: Courier companies - acting on presumption of being your broker agent - will sometimes jump the gun and start uploading scans of all the invoices, regulatory documents, etc. into the CBSA database, tied to the CCD of the shipment. Then they just tell you, “Your package is here! Pay our brokerage fees!”

``

Once the documents are uploaded, they can’t just delete government records. And they can’t destroy attached regulation documents, either. What I’m trying to say is, CBSA will either have the documents thanks to the Courier, or Glowforge can provide you with redundant copies to get the job done.

And that’s it!

Thanks a million, that will simplify things for me.

I dont even live in canada and i appreciate this…

Great information @dan_berry ! Could you elaborate further on the sidenote? Greatly appreciate all the hardwork you did.

It was just a somewhat snide comment that if the delivery person is already on your doorstep with your forge, procedurally they can’t just hand over the merchandise unless they’ve satisfied CBSA with all the paperwork and it was released from the CBSA warehouse.

By refusing the delivery guy on your doorstep, it means that (Courier) would have had to file all the paperwork for you and they’re hoping you’ll just pay them without asking questions.

The evil comes from this…

If you tell the courier at your door you’re self-brokering, they’re screwed: They’ve done the leg-work to get it released without giving you the due right to self-broker, and CBSA released it “in bond” to the courier. There’s no more legwork for you to do with CBSA, it’s already been done. It now becomes a game of chicken with the courier: does the guy take it back to the Courier’s warehouse, incurring MORE costs for delivery, or do they just write off the brokerage fees? If they offer to hand it over to you for ONLY the price of Duty+GST (which you calculated above, naturally) – take the offer. If they brought paperwork with them, look for (and refuse to pay) for the brokerage fee amount. Scribble on the paperwork for him.

Most courier companies avoid getting caught red-handed by this scenario by communicating with you before it’s at a CBSA warehouse, but depending on the service level (next day shipping, anyone?) that can mean they pay the fees ahead of time (“in bond”).

-

If you get a call from the courier asking for any more money (and I mean any), that means they’re trying to get your authorization to be the Broker Agent without saying that there’s a broker fee attached to it. You should only be paying Duty/Tax to the Government, not the courier. Glowforge will have already paid for courier fees up front, and they already clarified that “duty and brokerage are the responsibility of the purchaser”, so that can only leave you holding the bag.

``

Call the courier’s customer service and get the CCD (Cargo Control Document) from them. Ask for a PDF of the CCD to be emailed to you. You need this document because it’s the papertrail CBSA uses, and how you pay your duty/taxes. A blank sample and details of what it looks like can be viewed here. -

If you get a courier on your doorstep and you did not get a call first, then by accepting the package that means you’re accepting being billed at a later date (by mail)! Refuse delivery of it (Edit: and be clear that you’re self-brokering, not completely refusing!). I know it’ll be painful, but once you get the paperwork to CBSA, the courier is paid to deliver it the complete journey to your doorstep. It will return, even if the delivery courier does not write off the brokerage fees on-the-spot.

-

Even if you self-broker, you have a dilemma:

-

Do you retrieve your GF from CBSA’s warehouse where it’s being held?

-

Do you wait for CBSA to clear it so the courier can finish delivering it?

I’ve attached a sample of a “minimum” invoice, for use if CBSA isn’t happy with the commercial invoice Glowforge sends in email. Think of it like a cover page to the Glowforge invoice.

Good news is that you don’t have to worry about calculating the exchange rate conversion (unless you want to know for arguing with the Courier).

-

Box 2. Make sure the date matches the SHIPPING DATE from Glowforge.

-

Box 3. Change to be the Glowforge order number, if the emailed invoice includes one. Otherwise just leave blank.

-

Box 4. Change to be your address. Add your personal or corporate BN for their reference.

-

Box 12. Change to indicate if you ordered a GLOWFORGE BASIC 40W CLASS I LASER CUTTER or GLOWFORGE PRO 45W CLASS IV LASER CUTTER.

``

If you have other accessories such as the filter, you’ll have to figure that out - sorry.

-

Box 16. Change for any weight changes if you have the filter, etc. On their own, the Basic and Pro weight the same, so 32kg is correct unless they include complimentary Proof Grade materials to the shipment. I took the numbers from the FAQ.

-

Box17. Adjust for the Basic/Pro invoice price, and

-

Box 23(i). Adjust for the Glowforge shipping fees.

-

Box 18. Attach two copies of the emailed Glowforge invoice and put in the Glowforge-assigned Commercial Invoice No. from it.

sample ci1.pdf (65.3 KB)

I’ve been reading some of the comments and went to the CBSA website and used their calculator to see what the duties would be.

I used the category Electronics and Media then Printer. I ordered the Pro model and it cost 4070.00, I paid by credit card and the conversion ended up costing me 5444.01. With this figure the taxes came to 653.28 I then used a figure 800 less which you can use if you stay in the US for 48 hours thus 4644.01 and the taxes then came to 557.28 so a saving of 96.00. Of course you would have the cost of staying there for that long, but if you were visiting friends or family, it’s something to consider.

Cheers

So Trump got elected… NAFTA is  …

…

Good thing policies don’t change that fast… Hopefully we all have our Glowforges before he axes NAFTA.